Should You Pay Off Debt or Save For a House?

One of the most important things to do ahead of purchasing a home is to get your finances in check. A home is likely the biggest purchase of your life, so you need to be prepared. Furthermore, the better your finances and credit look, the better your chances… Read More

Can I Sue a Debt Collector?

When you miss your debt payments for long enough, your lenders might enlist the help of a debt collector. These people are hired by lenders to get you to pay back your outstanding debt. As they are generally more persistent and annoying than lenders trying to get repaid,… Read More

How Can I Consolidate My Debt?

When you’re dealing with a lot of debt, it can be a very daunting feeling. This is especially true if you’re unable to keep up with your payments. Not being able to keep up with payments can lead to a ton of financial hardships, such as bankruptcy. But… Read More

How Can I Guarantee That I Qualify For a Loan?

Applying for a loan can sometimes be a long and stressful process. Even once all the paperwork, emails, and phone calls are done, you often still need to wait a few days before hearing back. This period of time can be a worrisome one, especially if you’re dealing… Read More

What is The Minimum Credit Score Required For a Personal Loan?

When you experience an emergency in life, such as an unexpected medical bill or job loss, getting a personal loan can ease a lot of stress you are likely going through. But if you are in need of money quickly, you might be curious about what sort of… Read More

How to Use a Co-signer to Get The Loan You Need

With most cars, homes, and even consumer goods costing a pretty penny in many parts of the United States, it is almost a sure thing that you will need to secure a loan of some kind during your life. While this is fine if you have your finances… Read More

How Lenders Set Their Interest Rates and How to Beat Them

While there are a lot of factors that go into choosing which type of loan you go with, the interest rate is definitely one of the most important. A loan with a 2% interest rate will be much cheaper in the long run than one with a 5%… Read More

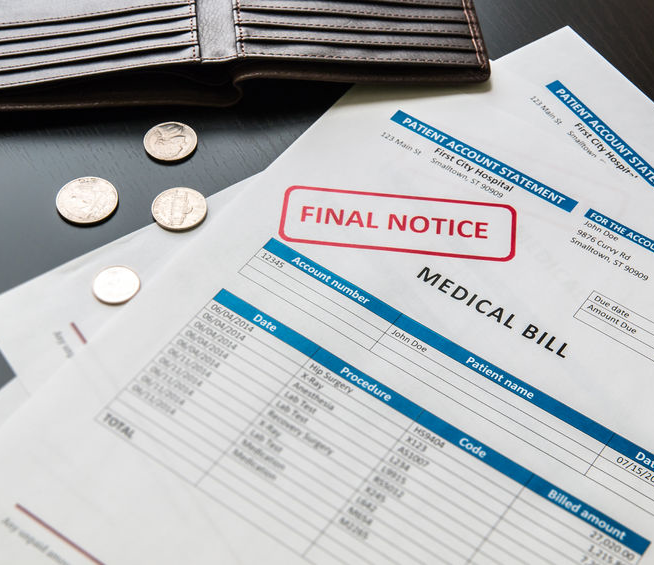

Will Medical Debt Show Up On My Credit Report?

Being seriously injured or going through a debilitating illness can be quite disruptive for your life in many ways. Of course, your body needs time to heal, which can put other things like work, sports, and many leisure activities on the back burner. When money is… Read More

Everything You Need to Know About Car Title Loans

If someone needs cash fast, they will often try to work some overtime hours, ask their friends and family for help, or apply for a payday loan. However, for any consumers out there who own a car, there is another method at your disposal. A car… Read More