Life Is About A Second Chance For This World Series Champ

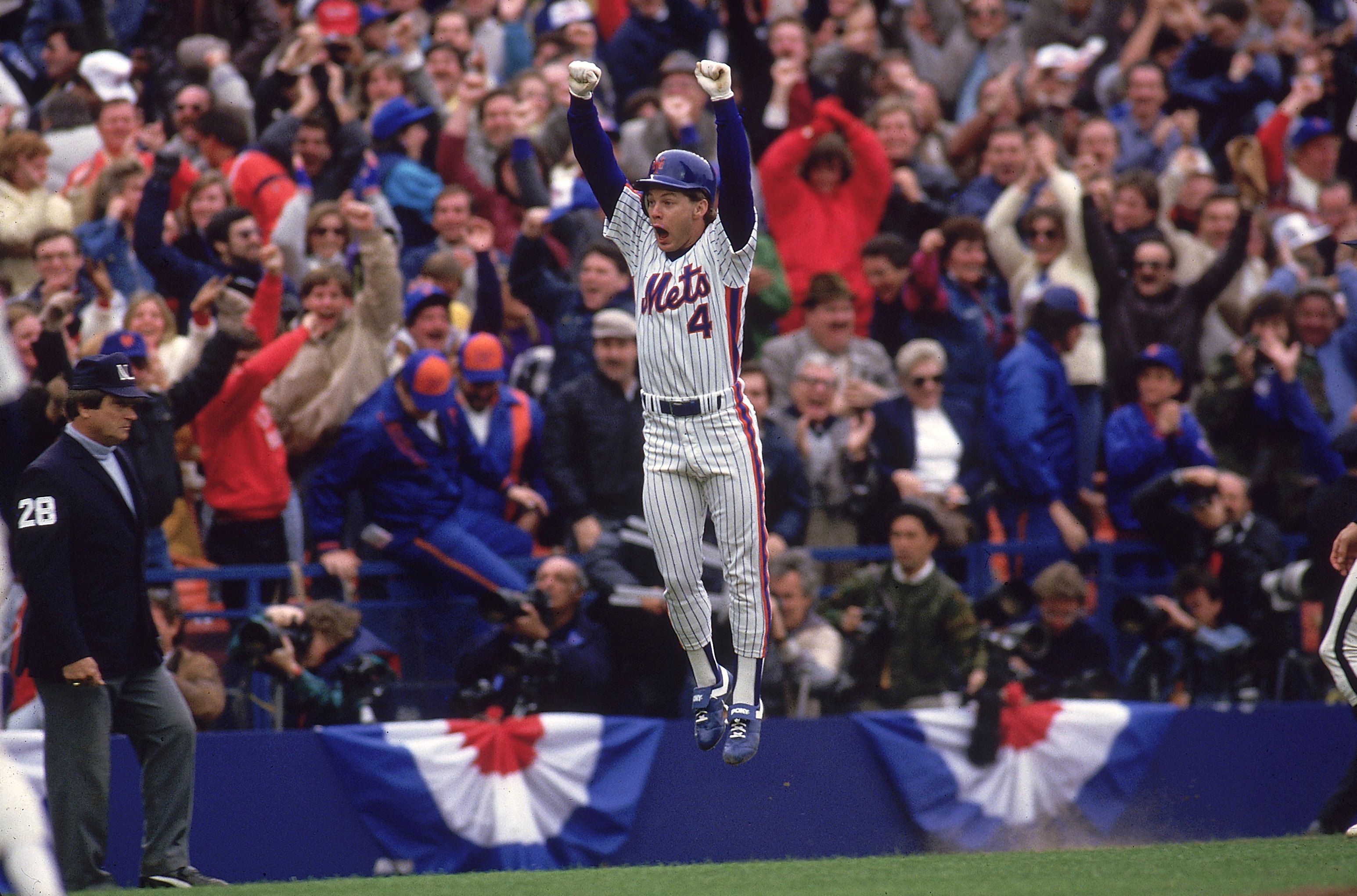

There was a time when Lenny Dykstra had it all. He was flying around the world in his own Gulfstream Jet, being chauffeured in his $400,000 Maybach, hanging out with celebrities like Robert De Niro in Italy, and partying with Charlie Sheen and Jack Nicholson in Hollywood. On the field, he was a 3-Time National League All-Star and played a key role in helping the legendary ‘86 Mets win the World Series. Traded to the Phillies, he put up numbers that made him one of the best players in the league.

Dykstra captured the hearts of baseball fans with his win-at-all-cost grit, his heart, and his talent on the field. Off the field, he became a multi-millionaire with a string of high-end car washes. He owned a series of multi-million dollar homes, including the Wayne Gretzky Estate. Then, before he knew what hit him, the lifestyle and its demands, in addition to the subprime mortgage crisis, took a toll on him, eventually costing him everything, including the Gretzky mansion, the Gulfstream Jet, and the Maybach. But the biggest loss Dykstra suffered was losing his family when his wife of 23 years divorced him.

Dykstra went from flying in his own jet to landing in Federal prison, as he was charged with bankruptcy fraud. But that wasn’t the worst of it. Post-prison, trying to survive with a financial reputation in ruins, was an uphill battle. He applied for loan after loan, but was turned down time after time. The rejection brought him dangerously close to wanting to give up.

Q: WAS THERE SOMETHING YOU LEFT OUT OF YOUR AUTOBIOGRAPHY (LENNY DYKSTRA: MEMOIR OF LIFE ON THE EDGE) BECAUSE IT WAS TOO PAINFUL TO SHARE AT THE TIME?

A: Losing my properties and businesses took a larger toll on me than I probably described. It’s hard to think about. The biggest loss was letting my family down. Then, after I served my time, trying to survive with a financial reputation in ruins, was an uphill battle. I applied for loans and tried to rebuild my credit, but was turned down every time. Even after I published my memoir and it became a New York Times Bestseller, banks still wouldn’t give me a loan. The rejection brought me dangerously close to wanting to give up. Until I got help from Rebound Finance.

Q: HOW MANY TIMES WERE YOU TURNED DOWN FOR CREDIT OR FINANCING AFTER YOU LOST EVERYTHING?

A: Too many times to count. Honestly, I have no idea. But, I’m not one to give up easily. I don’t believe you can succeed in life if you stop trying. Then Rebound Finance came into my life and gave me real hope. They delivered!

Q: HOW HARD HAS IT BEEN TO RE-ESTABLISH YOUR CREDIT?

A: Rebuilding credit is one of the hardest things I’ve ever attempted. The whole demoralizing experience is not one I’d care to ever repeat. There’s a lot of emotional damage that is caused when you’re no longer worthy of a loan. You find you must stop caring, but in the process, you stop caring for other things, even people, as well. I have always lived as a man of my word. Once people stop believing in you and your word isn’t an asset any longer, getting it back is a very steep uphill battle. When your word is no longer marketable, people don’t want to be around you any longer and life sucks. That’s why I have worked so hard to “Do what I say, and say what I do.”

Q: WHAT WOULD YOU WARN OTHER YOUNG ATHLETES AND CELEBRITIES TODAY WHO EARN A LOT OF MONEY?

A: That it’s good to enjoy the good life while you have it, but to always plan for an uncertain future. Have plenty saved for a rainy day, have lots of insurance, and always hire the best lawyers.

Q: ANY FINANCIAL ADVICE FOR OUR READERS?

A: Don’t take anything for granted. Don’t take your financial health (if you have it) for granted and don’t give up! There are opportunities to be had, and good companies like Rebound Finance are around to help you when the rest of the world is looking the other way.

Q: HOW ARE YOU RE-ESTABLISHING YOURSELF FINANCIALLY NOW?

A: By taking it one day at a time. By living smart and not overextending myself, and by not taking those who have helped me for granted. Even with my bad credit, Rebound Finance was able to get me a personal loan to take advantage of opportunities that could help me create financial stability. They also helped me consolidate debt and rebuild credit immediately. It doesn’t do well to dwell on the past, it can’t be changed. So, don’t give in, and don’t give up. It takes hard work, you got to be tough, and you must be determined to pull yourself back up. And sometimes you need help. When I come across a friend who may need to get out of debt or need a personal loan, I tell them to call Rebound Finance for help.

Lenny Dykstra is now back on his feet, appearing on the Howard Stern Show, talking to producers about a TV and Film version of his memoir, House of Nails: A Memoir of Life on the Edge, entertaining business ideas and having a healthy relationship with his family. “Rebound Finance gave me a second chance,” Dykstra explains. “And every American deserves a second chance.”

Need access to a quick and easy loan? Looking for help managing your debt? You can find the help you need right here at Rebound Finance.

Ayn Gailey has written for Elle magazine, Documentary magazine, HBO, PBS, and Showtime. You can follow her on facebook.