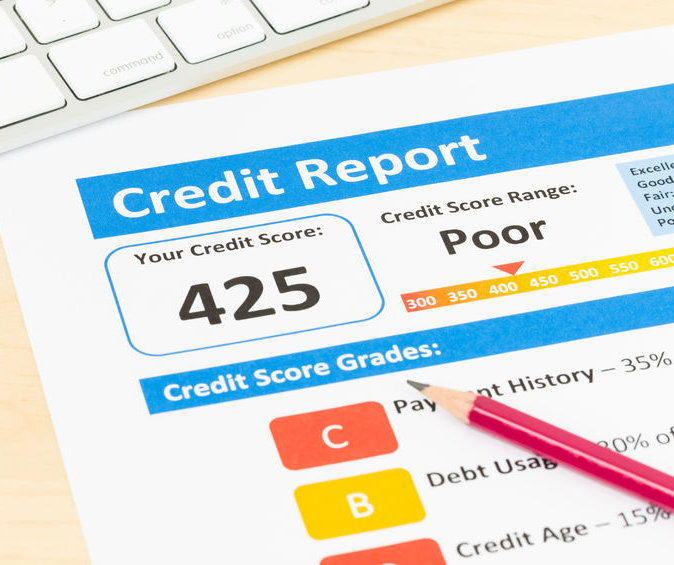

Credit Scores Ranges: The 3 Main Credit Reporting Bureaus

Ever wondered what your creditor looks for in your profile when you apply for a loan, credit card, or other credit product? Good question. Asides from your employment history and gross monthly income, one of the main components they’ll be examining is your credit score. You might not… Read More

Will Medical Debt Show Up On My Credit Report?

Being seriously injured or going through a debilitating illness can be quite disruptive for your life in many ways. Of course, your body needs time to heal, which can put other things like work, sports, and many leisure activities on the back burner. When money is… Read More

Can I Get a Home Equity Line of Credit if I Have Bad Credit?

Are you currently a homeowner? If so, do you have equity built up in your home? If you do, you might be able to pull some of that equity out in order to put the liquid cash toward other expenses. Haven’t bought your house yet?… Read More

How to Improve Your Credit Score Today

Dealing with bad credit is not only costly, it can also be a very stressful thing. However, just because you are currently dealing with a bad credit report or credit score, that doesn’t mean you will be stuck with it forever. Read More

What is Bad Credit?

Whether you’re looking to buy a new car or are interested in investing in a new home, you’ll more than likely need to apply for a loan. Unfortunately, if your credit is bad, it can be a little bit more difficult… Read More

How to Build Credit With Credit Piggybacking

If you ever plan to take out a car loan, rent out an apartment, apply for a personal loan, or even take out a mortgage in the near future, you’ll need to have good credit. Having good credit is a staple in the world of financing and loans,… Read More

What Really Happens When You Ruin Your Credit

Credit card balances, debt, and interest rates, what do they have in common? Most people are not that interested in discussing them. Debt is a serious subject and the balance you’re currently carrying around on your credit card might be because of an emergency or from a time… Read More

What Are Credit Inquiries?

When you, a potential lender, credit provider, employer, or other organization requests access to the information contained in your credit report, such as your credit score and credit history, this is known as a credit inquiry. At any time, you can personally request a copy of your own credit report,… Read More

What Can Credit Reporting Agencies Do For You?

In the United States, there are three major credit reporting agencies: Experian, TransUnion, and Equifax. Most people have some idea as to what these agencies are. They’re the all-powerful guardians of our credit reports, of course. However, what do we know about them beyond that? What do they do at… Read More