How Lenders Set Their Interest Rates and How to Beat Them

While there are a lot of factors that go into choosing which type of loan you go with, the interest rate is definitely one of the most important. A loan with a 2% interest rate will be much cheaper in the long run than one with a 5%… Read More

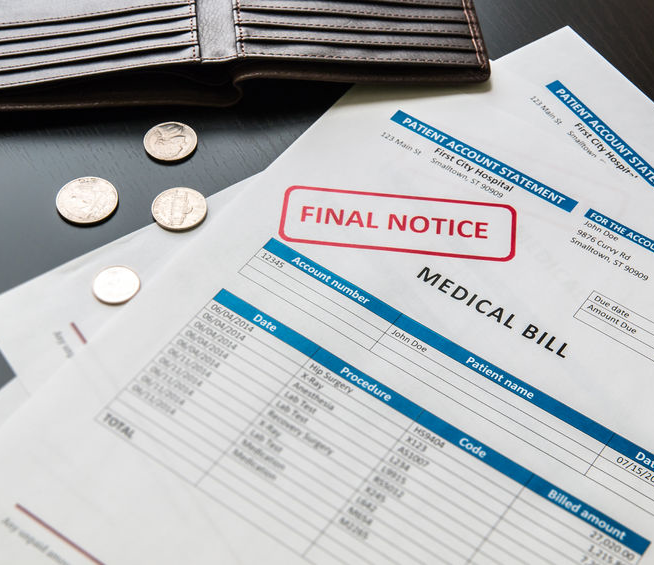

Will Medical Debt Show Up On My Credit Report?

Being seriously injured or going through a debilitating illness can be quite disruptive for your life in many ways. Of course, your body needs time to heal, which can put other things like work, sports, and many leisure activities on the back burner. When money is… Read More

Everything You Need to Know About Car Title Loans

If someone needs cash fast, they will often try to work some overtime hours, ask their friends and family for help, or apply for a payday loan. However, for any consumers out there who own a car, there is another method at your disposal. A car… Read More

Choosing the Right Type of Personal Loan

If you are in need of a loan, the good news is that you most likely won’t have too much trouble finding a place to apply. Most cities and towns have several banks, credit unions, or local lenders that will be happy to take your application for whatever… Read More

Dealing With Debt in Collection

Taking on debt isn’t a bad thing, as long as you can pay it off. If you can’t, not only will your credit take a hit, but you will often have to pay penalties for not honoring your loan agreement. Unfortunately, if you find yourself not being able… Read More

Payday Loan Alternatives When You Have Bad Credit

When you have bad credit, the options for you to secure money quickly via a loan are not always plentiful or high-quality. The “payday” loans you can get are often expensive, predatory, or a mixture of the two. The problem is that many… Read More

Debt Consolidation vs. Debt Settlement

While dealing with debt comes easy to some, for others, it’s significantly more difficult. This might be due to their low income, high expenses, or simply because they have too much debt to handle on their own. The good news is, if you are struggling with… Read More

Debt After Death

While it is very unfortunate, death is something we all have to deal with at some point in our lives. Whether it is a friend or a relative, it is always a very difficult situation to endure. Yes, it does often take ample time to mourn the loss… Read More

Should I Use My 401K to Pay Off Debt?

Dealing with excessive debt is never fun. Typically, we want to get rid of debt so quickly that most of us are willing to do whatever it takes, including using our 401k retirement savings. Then again, should you use some or all of it to pay… Read More