Debt Solutions: What Are My Options?

Struggling with debt is something many people experience. However, there are a variety of options you can choose from to improve your financial situation. These options can be catered to your needs and like most financial decisions you must make, all have positive and negative factors associated with them. Read More

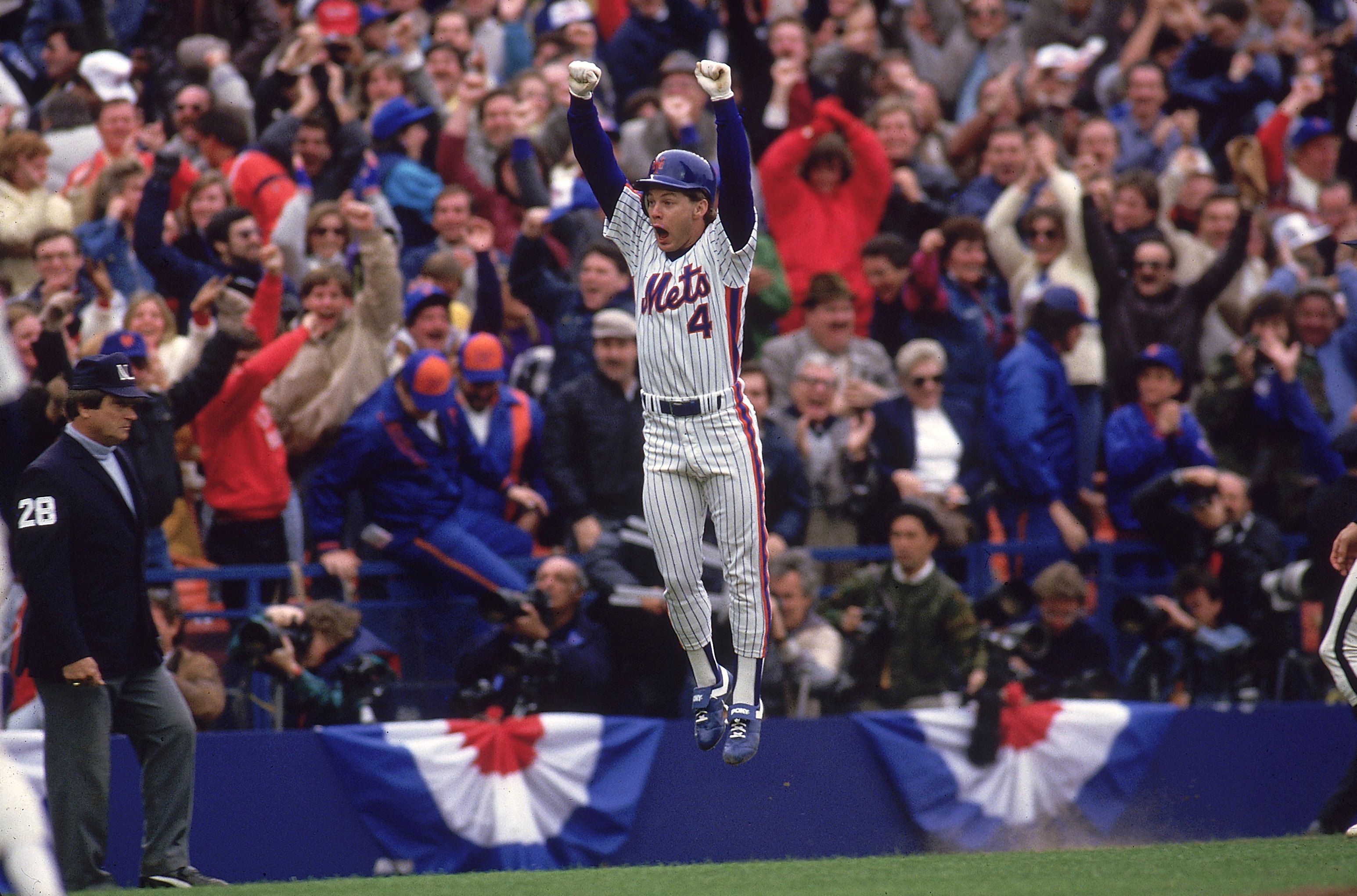

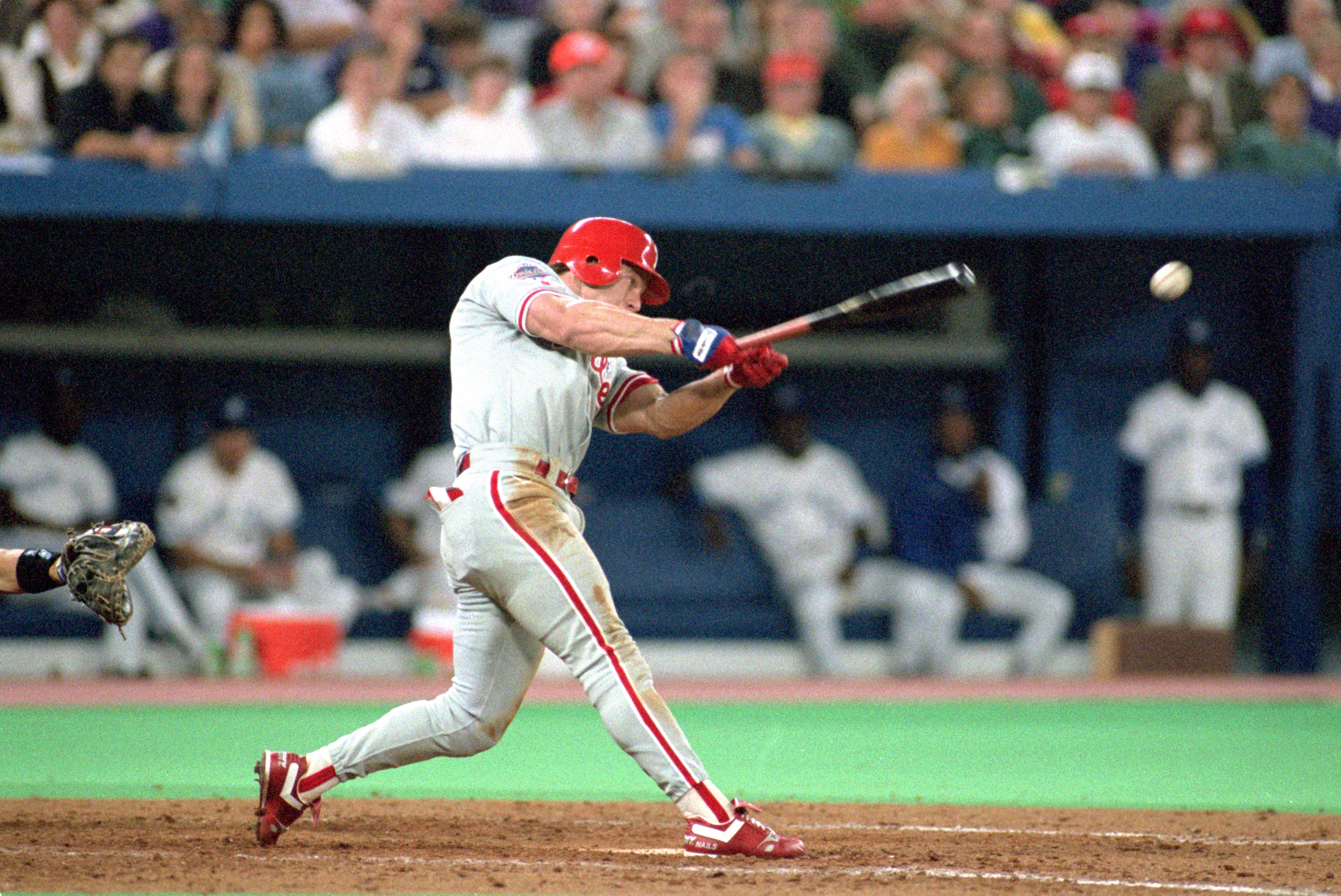

Life Is About A Second Chance For This World Series Champ

There was a time when Lenny Dykstra had it all. He was flying around the world in his own Gulfstream Jet, being chauffeured in his $400,000 Maybach, hanging out with celebrities like Robert De Niro in Italy, and partying with Charlie Sheen and Jack Nicholson in Hollywood. On the field,… Read More

Credit Monitoring, Is It Right For You?

In order to have financial success and achieve long-term goals, it’s always in your must interest to have a good credit score. Having a good credit score typically means you’ll be offered lower interest rates, competitive terms, and agreements, and have an upper hand when applying… Read More

How Will President Trump Affect Your Money?

Contrary to what many Americans expected, early last week Donald Trump was elected as 45th President of the United States. Regardless of how you voted, we’re sure that the majority of American citizens are concerned or at least curious about how a Trump presidency will, in fact, affect their money. Read More

How Rebound Finance Helped Me Get Back in The Game

One of the hardest parts of my journey was going from a person who paid everything on time, to a person who could no longer meet their financial obligations. There was actually a time when I had triple-A credit and was fanatical about always paying my bills on time. Debt was not an issue… Read More

Creating a Budget That Works For You and Your Lifestyle

Realistically, when it comes to creating a budget, it can often be a big hassle. Not only is it time-consuming, but it can also be difficult to determine how much money to use for each specific group of items and for what period of time (daily, weekly, monthly, or yearly). Read More

Credit Repair 101

Credit repair is a versatile financial tool. If you’re confident enough in your financial abilities you can go with the do-it-yourself rout or if you’re more comfortable with hiring a professional, there are credit repair services that you can pay for. Whichever option you choose, all the steps… Read More

Understanding Your Credit Report

Your credit report is a very important, detailed document including all the information concerning your financial history. Having a well-managed credit report will typically guarantee that you have a good credit rating and credit score. Not only will lenders see you as a less risky borrower when you have a… Read More

Our Top Money Management Tips for Families

Families come in all different shapes and sizes, which is why you have to match your financial strategy with your family’s situation and financial goals. Taking into account children’s wants and needs, while also considering your partner’s opinions, can make it hard to manage your money and make everyone happy… Read More